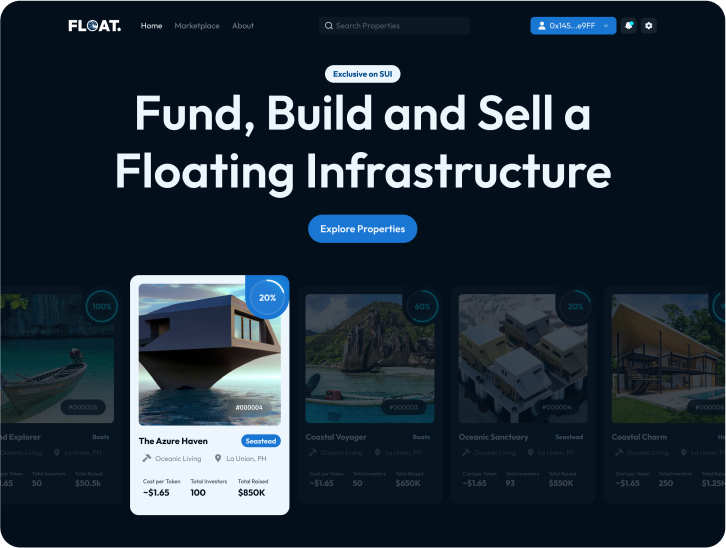

Exclusive on SUI

Leading the Tokenization

of Floating Infrastructure

A real-world infrastructure meets blockchain innovation, providing a seamless way to invest in and trade floating assets.

Float Finance is the first project on the Sui network dedicated to tokenizing floating real-world assets

Real-world infrastructure meets blockchain innovation

Providing a seamless way to invest in and trade floating assets

The Protocol

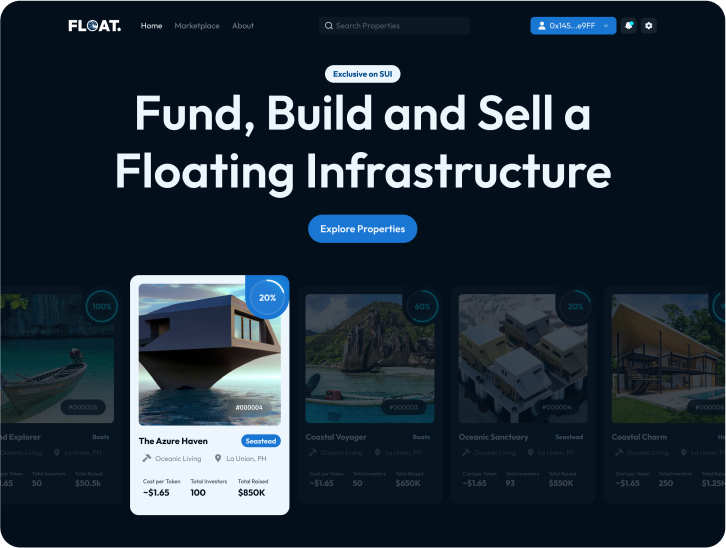

The Marketplace

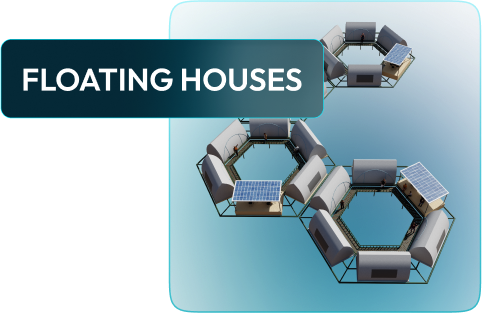

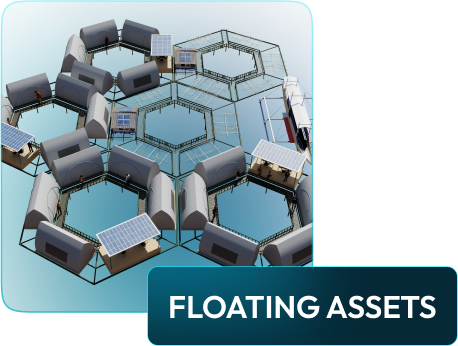

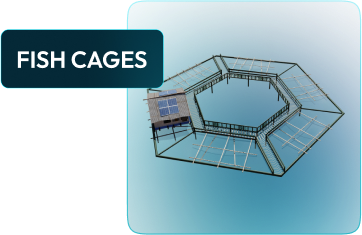

The Float Finance Marketplace is a platform where the team lists floating infrastructures such as floating houses, resorts, boats, and other marine assets, available for public funding.

The Protocol

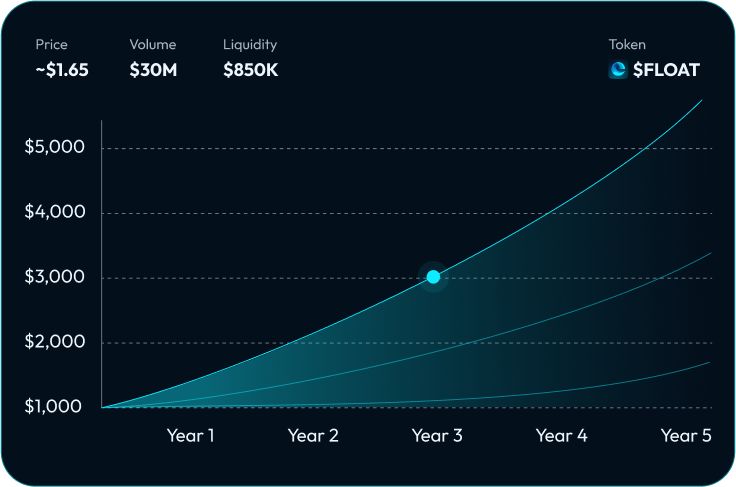

The Mechanism

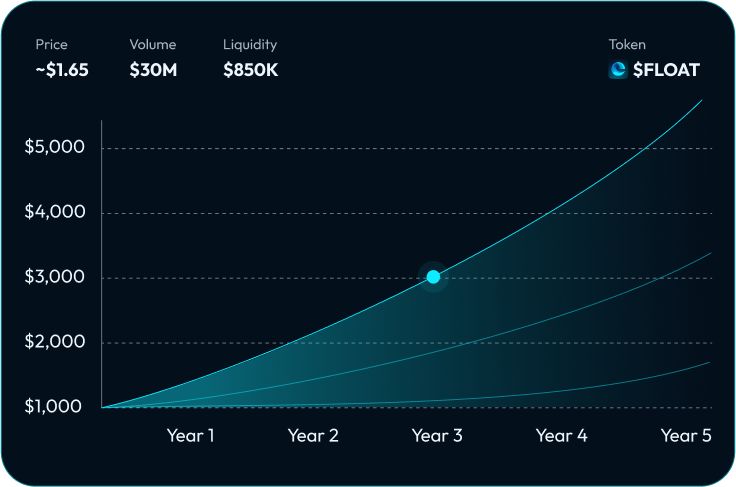

The Float Finance Marketplace is designed with a steady price growth mechanism, increasing the value of $FLOAT tokens by 0.1% each month. While the marketplace price follows this predictable trajectory, the public price on decentralized and centralized exchanges may experience volatility.

The Marketplace

The Float Finance Marketplace is a platform where the team lists floating infrastructures such as floating houses, resorts, boats, and other marine assets, available for public funding.

Participants can contribute to the development of these assets in exchange for $FLOAT tokens, which are tradable on public markets.

To enhance long-term value, the marketplace implements a dynamic pricing model, increasing the price of $FLOAT tokens by 0.1% monthly. This steady price growth benefits early supporters and reinforces the value of the tokens, making the marketplace an essential part of the Float Finance ecosystem

The Mechanism

The Float Finance Marketplace is designed with a steady price growth mechanism, increasing the value of $FLOAT tokens by 0.1% each month. While the marketplace price follows this predictable trajectory, the public price on decentralized and centralized exchanges may experience volatility.

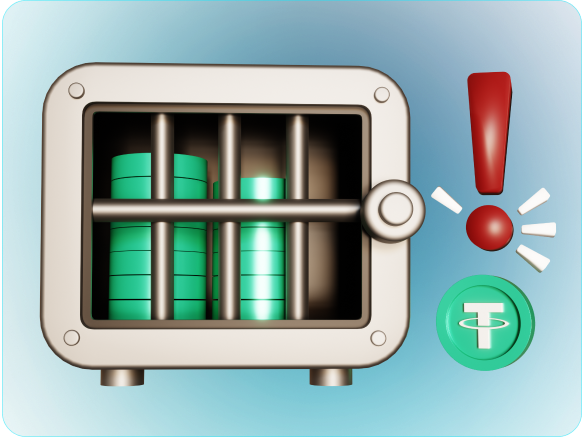

In instances where the public price falls below the marketplace price, the Float Finance team will utilize revenue generated from its floating infrastructures to buy back tokens, ensuring the public price remains above the marketplace level.

If reserves are to maintain this balance, subsequent monthly revenues will be fully allocated toward token buybacks until the public price stabilizes above the marketplace price. This mechanism ensures long-term stability and reinforces the deflationary nature of the $FLOAT token.

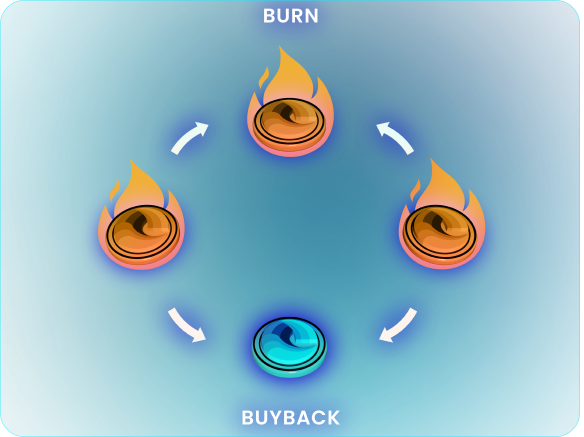

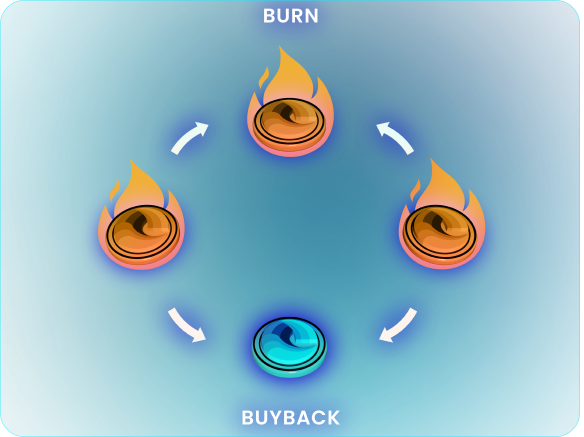

The Burning

Float Finance employs a deflationary model by using profits from assets like floating houses and boats to buy back and permanently burn $FLOAT tokens, reducing their circulation.

The Burning

The buyback and burn strategy reduces the $FLOAT supply, increasing scarcity and long-term value for holders, while promoting sustainable growth in the Float Finance ecosystem.